Recap of the AMA with Binance DEX telegram

Kori | Binance

AMA (Ask Me Anything) on our Telegram is live with C.R.E.A.M. ? https://t.me/BinanceDEXchange

The AMA will go like this:

? Part 1:

– The chat will be closed and Binance Angels will ask questions to the Helmet today.

– C.R.E.A.M will answer the questions

?Part 2:

– Then we will open the chat for the community. And you will be able to ask your questions ?

– C.R.E.A.M team will answer the most interesting questions you’ll ask in the chat.

? 3 $CREAM token to share between the 3 first questions answered

Kori | Binance

How are you guys ?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

Great! thanks for having us!

Kori | Binance

You’re welcome! Let’s start!

Can you please introduce yourself ?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

I am Leo Cheng, co-founder and project lead at C.R.E.A.M. Finance, and the Summoner of the Machi X DAO. Prior to Machi X,. I founded Blockstate, a San Francisco-based blockchain advisory service and served on the founding management team at Solano Labs, a cloud computing startup that was acquired by GE Digital.

Prior to entering the blockchain space, I’ve spent most of my professional career in tech across Apple, American Express and Belkin.

I received my BA in Economics from UC Berkeley and an MBA from the University of Michigan. I am also an electronica DJ — played in San Francisco, Los Angeles, and at Burning Man.

Kori | Binance

Can you please introduce your project and the problems you want to solve / Solutions you are proposing ?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

C.R.E.A.M. Finance is a decentralized lending protocol for individuals and protocols to access financial services. The protocol is permissionless, transparent, and non-custodial.

Currently, C.R.E.A.M. is live on Ethereum, Binance Smart Chain, and Fantom.

C.R.E.A.M. Finance’s smart contract money markets are focused on longtail assets — with the goal of increasing capital efficiency for all assets in crypto markets.

Users are able to lend any supported assets on our markets, and use the provided capital as collateral to borrow another supported asset.

C.R.E.A.M. offers a wide range of tokens on our money markets, including: stablecoins (USDT, USDC, BUSD); interest-bearing stablecoins (yCRV, yyCRV); defi tokens (YFI, SUSHI, CREAM, CREAM); LP-tokens (USDC-ETH SLP, BNB-BUSD Pancake LP); and other cryptocurrencies (ETH, LINK).

also we launched initially with the idea to cover underserved tokens like XRP, BCH, LTC. Currently users can still participate in DeFi on BSC with these tokens on BEP20. we are the lending arm of the Yearn Finance ecosystem.

Kori | Binance

What C.R.E.A.M Finance aims to achieve?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

C.R.E.A.M. aims to drive capital efficiency and meet the decentralized lending needs of individuals, institutions and protocols. We are building a trustless, automated & capital efficient financial market.

Kori | Binance

Currently, how many assets C.R.E.A.M. supports on C.R.E.A.M. on Binance Smart Chain?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

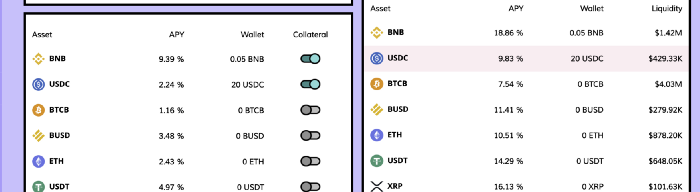

We support 40 BEP20 tokens on C.R.E.A.M. BSC, including BTC, ETH, BNB, BUSD, USDT, LINK, XRP, BCH, LTC, DOT, CREAM, ADA, BAND, EOS, DAI, XTZ, FIL, YFI, UNI, ATOM, USDC, ALPHA, TWT, XVS, CAKE, BAT, VAI, AUTO, renBTC, renZEC, BETH, IOTX, SXP, SUSHI, 5 PancakesSwap LP Tokens.

We’ve listed 5 PancakeSwap LP tokens recently:

CAKE-BNB

BNB-BUSD

BTCB-BNB

ETH-BNB

USDT-BUSD

Users can use PancakeSwap LP tokens as collateral for borrowing and lending. By using PancakeSwap LPs as collateral, depositors can earn supply interest while earning PancakeSwap rewards and LP trading fees.

LP positions are valuable collateral. As collateral they will be used to generate further liquidity and earnings for both the original farmer and other market participants. And this is all about capital efficiency.

i see having an LP position as having a small stake in an exchange. your own exchange. your own business. so put up your small business ownership up as collateral. can borrow more to leverage up cheaply or borrow other tokens.

Kori | Binance

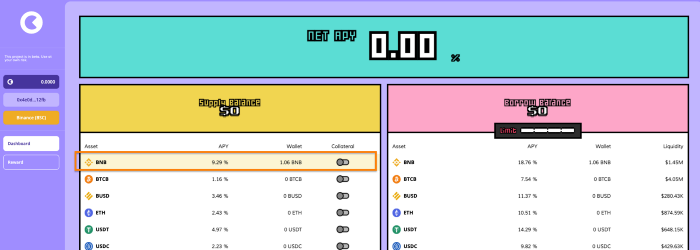

How to use C.R.E.A.M. on BSC? Can you give a step-by-step guide on how to begin?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

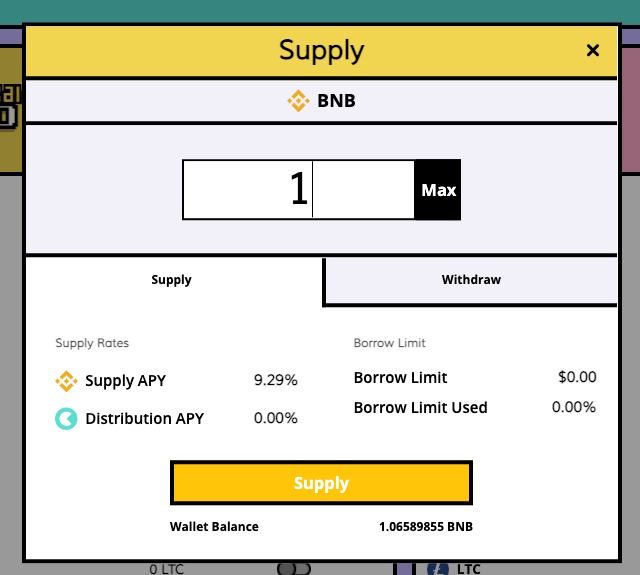

How to use C.R.E.A.M. on BSC?

- Create a BSC Wallet First.

- Get some BEP20 Assets

- Go to app.cream.finance

- Choose the BEP20 asset you want to supply

- Type the amount and click on the ‘Supply’ button.

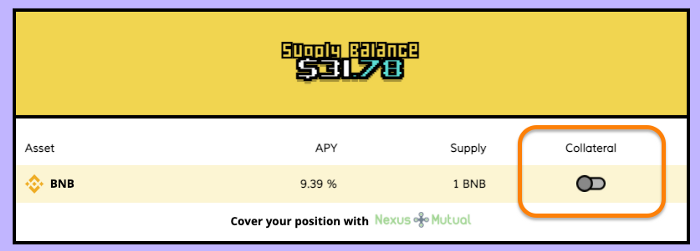

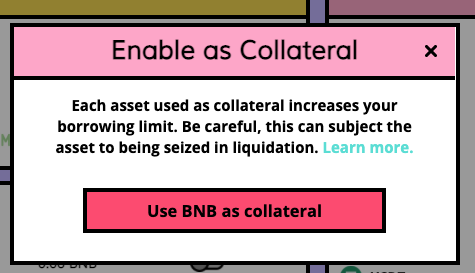

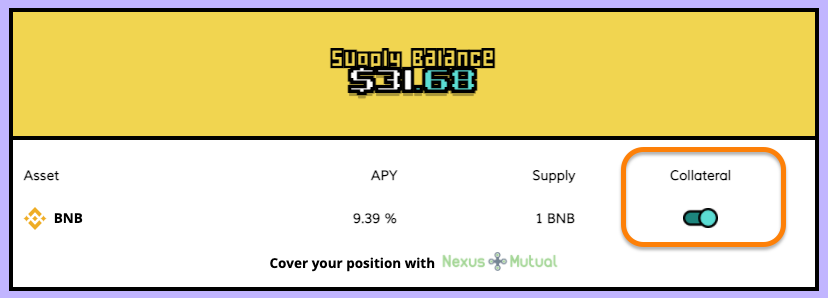

If you want to borrow assets on C.R.E.A.M. You can choose the BEP20 asset you have supplied and set it as collateral.

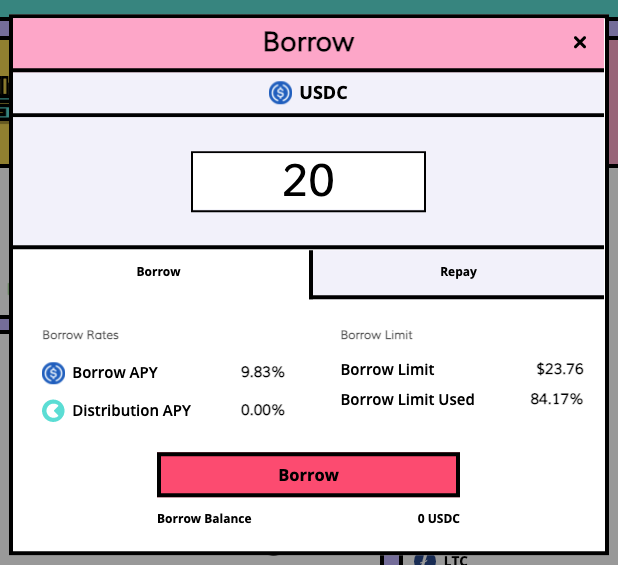

Choose the asset you want to borrow.

Enter the amount and click on the ‘Borrow’ button.

When the transaction is completed successfully, you will see your borrowed assets shown below.

Now you know how to supply and borrow assets on C.R.E.A.M. BSC. You can also check out our beginner guide on C.R.E.A.M. Official Medium to learn how to long and short assets on C.R.E.A.M.

Kori | Binance

It has come to our attention that you have launched Flash Loans on the Binance Smart Chain. Can you explain how it works?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

Yes. We recently launched Flash Loans across the C.R.E.A.M. full ecosystem — The Iron Bank, C.R.E.A.M. v1, C.R.E.A.M. BSC, and C.R.E.A.M. Fantom. Very exciting.

This is a major step in C.R.E.A.M.’s mission of becoming the most capital efficient money market in crypto. We offer the largest set of flash loanable assets on the market. Users can now access flash loans on many more assets than before, at the cost of 0.03%, which is cheaper than other money markets.

Also, C.R.E.A.M. is the first money market to bring flash loans to Binance Smart Chain. Devs building on C.R.E.A.M. BSC is able to gain access to more than $90M of liquidity available for flash loans from our launch.

flash loans are hard to use for individual users directly, but lays the foundation for many more defi innovations. another thing to note here is that Flash Loans get a bad reputation for hacks… it’s just a tool that people can leverage. for example, with flash loans, anyone can make money on liquidation bonuses, without having a lot of money on hand. without flash loans, liquidators will need to hold enough capital to execute on liquidations. Flash loans removes that requirement.

Kori | Binance

Are there any other updates or developments you are working on at C.R.E.A.M. BSC?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

Yes. C.R.E.A.M. keeps working to strengthen our ecosystem. Security is the key to maturing the decentralized finance ecosystem and bringing emerging financial technology to more users across the globe. We are delivering increased project transparency, preventing hacks and providing a clear path for users to buy insurance coverage with multiple partners. We’ve got some exciting news about the improvements that will be released in a few hours. Please follow our official channels for further details.

https://docs.defisafety.com/finished-reviews/c.r.e.a.m-finance-pq-review

We are also in the process of launching a new security feature — Collateral Cap — which is finishing its audit and is expected to be released in the coming weeks. Collateral Cap will limit the amount that each asset can be used as collateral on C.R.E.A.M. without limiting the amount of each asset supplied. given our focus on long tail assets, we need stronger/better/more security features

In addition to security development, we are also working on redesigning the UI/UX to give our community a better user experience on our protocol.that, and also to look more grown-up. institutions like the grown-up look so we unfortunately may be doing away with the Grand Theft Auto look and feel soon.

Finally, we’re constantly looking at the latest liquid assets on BSC and adding them to C.R.E.A.M. as users need them. ah and partnerships. lots of partnerships.

Kori | Binance

Thank you for your time and all your answers. What is the best way to follow all your upcoming news and updates ?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

You can describe our weekly newsletter “C.R.E.A.M. Communications”, contribute to our community on our Forum and Snapshot, and find all the latest updates on our Twitter, Medium and Discord Thanks for having me. It’s always great to connect with the BSC community. we’ve always been supportive of BSC since its launch.

3 questions answered by C.R.E.A.M.:

Q1: I am an EXPERIENCED DEVELOPER AND ETHICAL HACKER, does you have plans for HACKATHON so as to check the security of your ecosytem periodically and also invite developers to build?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

Yes we are working with the BSC team on a hackathon soon for building things on BSC. with regards to security, we are very soon announcing a bug bounty program where we invite whitehat hackers to poke around

Q2: Where do I get information about your team? Why do you prefer to be anonymous? Do you have a plan to identify your team later?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

We are not anonymous. Many of our team members are publicly disclosed, and I’ve been on podcasts including Coingecko and Delphi Digital where my identity is disclosed. You can learn about the identities of our team by going to docs dot cream dot finance / about.

Q3: DeFi is one of the hottest and most sought-after topics in the blockchain space right now. Can C.R.E.A.M share your opinion on DeFi with us? Do you think DeFi will disrupt the current financial system? What is C.R.E.A.M’s approach to the DeFi sector?

Leo Cheng | Co-founder & Project Lead of C.R.E.A.M.

Our protocol to protocol lending that we’ve currently opened on the Iron Bank on Ethereum is one key innovation to address this. We are enabling further capital efficiency by allowing trusted protocols to borrow from C.R.E.A.M. directly on a credit line, making yields higher for partners like Alpha Homora v2 and Yearn Vaults. we are bringing protocol to protocol lending onto BSC as well — you heard it here first.

Ten articles before and after

5 Money-Making Telegram Bot Ideas – Best Telegram

My Pain Points writing a Telegram Bot (in Python) – Best Telegram

Telegram VS Whatsapp. Which one should you choose? – Best Telegram

Pundi X integrates Telegram chat and adds Crypto Gift feature for its XWallet app – Best Telegram

10x Growth in Presearchers, Presearch Community Telegram Blowing up! – Best Telegram

Full guide on creating stateful Telegram bot – Best Telegram

Crowny Twitter & Telegram Contest – Best Telegram

Talking with Arduino using Telegram and JavaScript – Best Telegram

Get Verified in One Click: EXMO Integrates The Telegram Passport Option – Best Telegram