BlockBank — Telegram AMA — April 02

On Friday, April 02, we had the pleasure to welcome to our Telegram chat:

Kelghe D’Cruz, CEO,

Anastasija Plotnikova, CLO

Nolvia Serrano, CMO, and

Darren Franceschini, Co-Founder & COO.

We asked them questions about the development of BlockBank.

Some sentences have been slightly edited for readability but the meaning has been conserved.

Summary

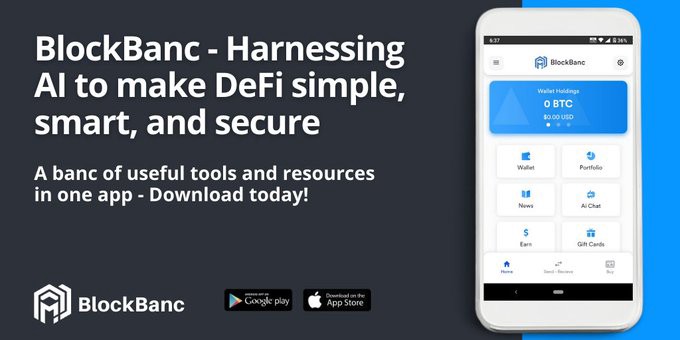

BlockBank is on a mission to offer an AI-powered, traditional mobile banking experience with seamless crypto integration. The project aims to combine the best of the DeFi and CeFi worlds in one place, incorporating AI technology to bring financial empowerment to clients in a very simplified manner.

BlockBank’s patented AI Robo-advisor monitors, gathers, and provides data in real-time based on investment preferences to maximize gains and minimize unnecessary losses.

With BlockBank’s utility token, $BBANK, users are able to gain access to their credit card rewards program, use advanced AI assistant, increase their APY % and earn interest on their tokens by staking $BBANK in their non-custodial BlockBank cryptocurrency wallet.

Introduction

Q — Ayeley Commodore-Mensah from GAINS: Let’s start by hearing a bit about you. What did you do before crypto and did you have any other previous venture in crypto?

A — Kelghe from BlockBank: My name is Kelghe (KELJ) — super hard to pronounce! I am the co-founder and CEO of BlockBank Before this, I had an education company that dealt with complex healthcare topics and was a partner in a software development company that worked with some pretty cool AI technology.

My first crypto venture was in mining back in 2013 and I was one of the first to sell tokens on eBay back those days.

A — Anastasija from BlockBank: Hello amazing people! I am Anastasija, Co-Founder and Chief Legal Officer of BlockBank. I started my career years ago at the European Union law enforcement agency where I first came across bitcoin and was fascinated by the technology and potential behind it. Helped the regulator of Lithuania to draft “crypto laws’’, trying to lobby for the industry’s best interests. Was a COO of a Canadian blockchain company, where we have implemented track trace solutions for medical cannabis. Was part of the original ETHLend/AAVE team, where I was very happy to work with Nolvia. Consulted multiple companies on crypto regulations and efficient implementation. I know very well that legal is not the topic people are getting super excited about (lol) but my job is to make it “all happen”, ensuring that users are safe, protected and the company can achieve everything that we say we will do.

A — Nolvia from BlockBank: I’m Nolvia Serrano, CMO for BlockBank. I previously worked at Citibank, in the PR and Communications department, then I moved to an investment company, where I discovered the amazing world of crypto. Being from a developing country, this was fascinating to me because I could see clearly the need for a change in banking and investing.

About BlockBank

Q — Ayeley Commodore-Mensah from GAINS: What is the project about in a few simple sentences?

A — Nolvia from BlockBank: In early 2017 I joined ETHLend — now AAVE — as CMO and I worked alongside Anastasija, which was a thriving experience being the amazing blockchain professional she is. I’m super excited to now be part of BlockBank and build the banking experience we all would love to have, one that simplifies the user experience without compromising security, privacy, or decentralization.

A — Kelghe from BlockBank: Blockbank is on a mission to simplify the user experience without compromising security, privacy, or decentralization. The complex nature of DeFi platforms requires elegant trade execution and earning strategies to avoid high gas costs and slow speeds

We optimize multi-step DeFi purchasing processes and add a powerful AI assistant.

Our AI assistant’s patented technology brings the analytical power equivalent of hundreds of highly skilled financial analysts to the palm of our users; leveling the playing field between retail and institutional investors.

The info is out there and there is so much of it, we are able to compress it, validate, and then give our users actionable data 🙂

A — Nolvia from BlockBank: In brief, BlockBank is on a mission to simplify the financial services user experience without compromising security, privacy, or decentralization. We optimize multi-step DeFi purchasing processes and add a powerful AI assistant.

Q — Ayeley Commodore-Mensah from GAINS: For how long have you been working on the project? And how many people are on the team?

A — Nolvia from BlockBank: The team continues to grow, so far we are a team of 10 people but as the project has been expanding, more people will be joining our team shortly.

We have started and self-funded development since 2018, launched in 2019 (just to face crypto winter), gathered a lot of user feedback, and continued to work and develop. We are very happy to have super experienced and driven people on board, including the AI/machine learning inhouse team (just a hint, one of them works at Hadron Collider)

We have been working since early 2019, some have been since the beginning and others, like me, have recently joined.

Q — Twitter user @AugustK95: You say that your advisor robot provides real-time data that will help to maximize profits and minimize unnecessary losses, but is that data really so reliable that it always provides accurate data in such volatile and indecipherable markets?

A — Kelghe from BlockBank: Being in the crypto space for quite some time you start to realize that from an analytical perspective the markets aren’t as indecipherable as one might think. Volatile yes but due to the oracles, data sets, and other variables we are incorporating into the Robo advisor we believe it will become the most trusted unbiased tool in our market. The processing power of our tool is immense and because the data is being pulled in real-time it can effectively quantify all data to provide accurate results. This technology already is being used by fortune 100 companies in the real world today and has proven to be up to 99.8% accurate, and the tech does this right now.

Q — Twitter user @KevinSalom1: You guys comment that your AI assistant brings the analytical power equivalent to hundreds of highly skilled financial analysts Is this really possible or is it exaggerating a bit? How have you been able to collect so much information and simplify it into a single AI bot?

A — Kelghe from BlockBank: It is anything but simple. We can make these claims because as stated before this technology is being used in fortune 100 companies, as well as one of the largest American banks right now. Data being accumulated, analyzed, learned, and compiled all with one main function which is to provide insights on market trends and investment strategies is its core function. It will be expanded over time to more interactive functions like trade execution or APY chasing however that will take more time on the technology learning the interaction between each user including their risk profile, current strategies, and their intended returns they wish to achieve.

We have a breakdown of the tech in the whitepaper along with the patent diagram. You can find our whitepaper and light paper here.

A — Nolvia from BlockBank: As you see, this technology is not a prototype, but a proven concept that is currently being implemented in big companies.

Q — Telegram user ⋅ ℝ???????? ? ⋅: ‘Blockbank is building and developing the infrastructure and decentralized financial service for Banking 3.0’. Why do you say that the platform will provide a seamless user experience? What are the tools that bring convenience and efficiency to users?

A — Kelghe from BlockBank: Biggest barrier for crypto is that it’s never been that simple, from way back in 2013 (when I got into it) till now there is always something complex about it. Making it simple and coupling it with our AI, will only give our users the upper hand.

Q — Telegram user Amina Peter: What are the attractable features that will make one save or invest his money/assets in Blockbank than invest in the traditional bank?

A — Anastasija from BlockBank: It will be your 1 app for crypto and banking, eliminated the need to have multiple applications that all cannot be used at the same time.

Q — Telegram user Moises: It caught my attention that your BlockBank project has 3 highlights, blockchain, Defi, and artificial intelligence, so I wonder, how do each of these 3 complements each other?

A — Kelghe from BlockBank: Great question, Imagine moving fiat to crypto and then performing a trade. But using the AI to do the full process

A — Anastasija from BlockBank: Those are indeed the building blocks of the infrastructure — all integral and important. DeFi is the underlying base for everything in crypto, CeFi brings us convenience and payments. AI is what makes every user more qualified to do everyday transactions, make decisions. So these 3 verticals are being integrated as we speak.

Token

Q — Ayeley Commodore-Mensah from GAINS: What is the token use case and how does it capture the value of the ecosystem you’re building?

A — Anastasija from BlockBank: BANK token will be an essential part of the application. BANK holders will receive reduced fees, extra staking rewards, higher APYs, better deals on insurance (and other third-party services). Also, they will be able to use all features of an AI assistant.

The Bank token economic model was thought through extensively within the internal team and its outside advisors. We wanted to give everyone the ability to have a fair and equitable chance to participate while ensuring there are no major events to see massive declines in price. We have factored into our model also a buyback strategy as we always have to have a big enough reserve to ensure we can provide staking and referral rewards for our users.

Q — Twitter user @Rarr0103: I understand that the token “BANK” can be used to increase the APY from 10% to 30%, but can you explain to me what is the basis of the token to generate so many percentages? And by using BANK, apart from generating 30% APY, can I get passive income by keeping it in my wallet?

A — Kelghe from BlockBank: Absolutely, using the bank token only to stake you can receive up to 20%. We are providing our staked users with the incentive to stake their tokens with us and are more than happy to provide such a high percentage as they are effectively taking these tokens out of circulation and believe they should be rewarded. Being a bank token holder unlocks many different features in the application as well (unlocking different levels of information from the Robo advisor, exclusive offers, cash back on purchases using the card, insurance, 3rd party rewards, different banking tiers without having a monthly fee, and reduced fees). To receive the additional 10% APY in BANK this comes from users who stake other assets in our platform for specific periods of time the longer they stake the more bank bonus reward they can receive. We also have a buyback strategy to always ensure the reserves stay at a specific level to ensure we consistently have enough BANK to reward users moving forward.

Q — Telegram user ⭐️Karla⭐️: Regarding your $BANK token, I read on your website the multiple uses it has within your ecosystem, but I didn’t read anything related to governance power, how can users then give their opinions and votes?

A — Anastasija from BlockBank: We are not implementing governance at this point. to be honest, until all the tech is ready and fully deployed we cannot risk any delays, that sometimes happens with DAOs+it is much harder to secure the banking relations

Q — Telegram user iffh sfnd: In the rewards concept, you say that the more BANK tokens, the more APY you could gain. Could you tell me the base calculation planning?

A — Anastasija from BlockBank: Using the BANK token only to stake you can receive up to 20%. We are providing our staked users with the incentive to stake their tokens with us and are more than happy to provide such a high percentage as they are effectively taking these tokens out of circulation and should be rewarded. For the exact calculation, the exact formula will be provided in the app/website shortly.

Competitive Advantage

Q — Ayeley Commodore-Mensah from GAINS: I’m pretty sure there are other crypto projects that provide the same or similar services. What sets you apart?

A — Kelghe from BlockBank: What we are doing is very unique and what really setups us apart is our Digital / Robo advisor.

A — Anastasija from BlockBank: And the key is that it is a legit patented tech with the trusted partners that work out of Silicon Valley, SKAEL. So it is them+our in-house team that is developing AI assistants for your everyday use.

Partnerships

Q — Telegram user ꧁ ᒍᑌᗩᑎ ᔕᗩᑎᗪOᐯᗩᒪ ꧂: Among the partners and sponsors, are the banks associated with BlockBank? How does BlockBank relate to traditional finance? How would you improve the function and use that banks make of user funds?

A — Anastasija from BlockBank: We are in the active phase of 1) partnering with banks (2 are confirmed) as well as applying for a payment license

A — Darren from BlockBank: To be honest the banking side completely came into existence to work with blockchain companies and crypto users who are having difficulties in the traditional banking space. I know we have all probably experienced it. We cannot expect them to change without being provided examples of how they can be improved and work. We aim to be that example.

Q — Telegram user Dayo: Can you tell us more about your partners? How exactly will they help in achieving your ultimate goal?

A — Kelghe from BlockBank: They are helping us in so many ways. One of the few ways is a wallet partnership and introducing us to their community and users.

A — Anastasija from BlockBank: Every partner didn’t just bring $, they are bringing connections, introductions, payment solutions, and exchanges. we have questioned every one of them haha

Q — Telegram user Hanchelt: What was the cost to apply for a Mastercard / Visa card in BlockBank? Which bank will you affiliate with for this service?

A — Darren from BlockBank: We actually have a few banking partners and one of our founders is affiliated with a provider as well.

Finances

Q — Ayeley Commodore-Mensah from GAINS: You have been around since 2019. Did you raise funds so far? If so, how did you handle them? Are you planning to do any future raises?

A — Kelghe from BlockBank: We are in our private round and it’s going very well. We are overwhelmed by the support we get from the community and investors. We have locked up SAFTs with major partners, pools, VCs, and syndicates. We are happy to announce that we are listing on BSC as well at the same time as Ethereum, so stay tuned for the announcement on double IDO.

Security

Q — Telegram user Seskia: Smart contracts are one of the most important security objects. The smart contracts in your project have been audited internally or externally. So how does BlockBank prepare for this condition?

A — Kelghe from BlockBank: Love the question, Yes our contracts will be audited externally by 2 separate companies. We go through each process individually and oversee the deployment of the contract itself.

A — Anastasija from BlockBank: so we have an internal team, plus everything will be audited by the third party before the deployment (Zokyo or Certik). Also, our AI will be monitoring the smart contracts for known vulnerabilities, it is in process of testing, so hopefully in V2.1 🙂

Business Development

Q — Ayeley Commodore-Mensah from GAINS: What stage is the project at? And what should we look forward to in the coming months?

A — Anastasija from BlockBank: We launched our Beta version in late 2019 and have been adding features based on our community feedback. At the moment we have around 25k users and 100M TVL. At the moment our users can enjoy a simple and convenient non-custodial wallet with a credit top-up function and multiple gift cards to cash out. The latter function is heavily used by our users in India, where they face many restrictions on the use of crypto.

We are building out the next evolution of the app which will bring in the full banking experience and bridge the DeFi Gap. Along with that, our users will get access to a sophisticated Robo advisor to help them navigate this space. The dev team and AI team are working hard to bring as many features as possible to the V2 of the app.

Q — Twitter user @AbMahmuddd: Tell us about your plans for 2021, what are you currently working on, and are you going to expand the list of big exchanges?

A — Anastasija from BlockBank: We are in the process of releasing an application update of the current beta version to include web 3 so users can access DeFi dApps in their wallet and use funds they store in their non-custodial wallet. Our V2 application is being developed in parallel which is an absolute rebuild from the ground up. We needed to do this as we are integrating true banking into the platform and have many regulatory and compliant development features to be accepted by central banks who will allow us to access the banking infrastructure. Our Robo advisor is also in development in conjunction with our application as it needs to be interconnected to each aspect of the application to ensure it functions most efficiently. We are also adding a more CeFi aspect to our application: a custodial wallet, fiat on and off-ramp, and some other exciting features we will announce through pr releases. In terms of big exchanges, we are actively in discussions with them however our immediate release upon listing will be Uniswap and Pancakeswap at the same time as we are excited to be having an IDO on ETH and BSC.

Our partners/VCs all are helping us with listings and other material stuff like partnerships.

Q — Telegram user Chowdhury saheb: DeFi is one of the topics in the blockchain space right now. Can you share opinions (BlockBank) on DeFi with us? Do you think that DeFi will disrupt the existing financial system?

A — Anastasija from BlockBank: We live and breathe crypto. Our goal is to include all users — if they don’t need CeFi services they can happily stay and use the app+features without KYC

A — Nolvia from BlockBank: Anastasija and I both come from the DeFi space, we both have been working with ETHLend — Aave since the beginning and I can tell you there is still a lot more to be accomplished in the space. DeFi is already disrupting the financial system, people want freedom, transparency, and security and DeFi covers them all.

Q — Telegram user Kevin Salom ?: One of the problems facing DeFi platforms is high transaction fees that can easily destroy the profits of small investors, so what solutions does BlockBank offer in this regard? Any way to save us some commissions?

A — Darren from BlockBank: Commissions not really what we can offer is our Robo advisor being able to advise on a various number of factors including gas fee prices, trends, and signals based on your preferences to provide you the most accurate data to save your overall net returns on your portfolio

A — Anastasija from BlockBank: This is a big problem for eth-based transactions, we are working internally to optimize the fees, for the CEX side they will be much much cheaper, and for BSC fees are low, and we support BSC.

Q — Telegram user ????????: How would Blockbank bridge the gap between DeFi and CeFi?

A — Darren from BlockBank: Having banking, custodial wallet as well as a non-custodial wallet in one app. We are actually allowing users who only want to participate in DeFi with non-custodial no KYC requirements as long as they only use the non-custodial and web 3. Once they want to access banking and custodial wallets they will need to provide them. Bridging, in this case, means one app to participate in both sides of the crypto space without needing to leave one platform.

Q — Telegram user tehMoonHunter ?⚡️: Will it be possible to adapt your app to the WEB3 and the V3 of Uniswap that is set to be launched on May 5 without problems.?

A — Kelghe from BlockBank: We have this in the works, and it will go through its testing process before release.

Q — Telegram user Godpelpa: If you get the investors and the necessary resources, what would BlockBank look like in five years?

A — Anastasija from BlockBank: We would like to be a household name 🙂

Thank you for coming in today guys. Certainly one of a kind as we had Sponge Bob featuring. We really learnt a lot. Anything else you’d like to say? Where can we follow you to stay updated? — Ayeley Commodore-Mensah from GAINS

Thank you so much for all the questions, what an amazing community! Huge thanks to mods and all participants❤️❤️❤️ Thank you for accommodating us and hosting this AMA! Join us on this exciting journey! — Anastasija from BlockBank

Super impressed with the question quality. NOT ONE — WHEN MOON question! We are super grateful for you giving us your time everyone — Kelghe from BlockBank

Everyone we are also always open to answer anything we missed in our Telegram channel or through DMs we make sure to answer anyone who asks us — Darren from BlockBank

Thank you everyone, it was a pleasure being here with you.— Nolvia from BlockBank

Join us now! Enjoy quality articles, daily curated news, insightful infographics, and enter a vibrant, fun, and knowledgeable community!

Website | Telegram ANN | Telegram Group | Discord | Twitter | YouTube

Ten articles before and after

Crowdholding Telegram Airdrop Announcement – Best Telegram

Telegram: ¿Infidelidad o Negocios? – Best Telegram

Highlights From The MEDIA Protocol And Quadrant Protocol Telegram AMA – Best Telegram

The OLPORTAL Telegram Community is Now 10K Strong! – Best Telegram

AIOZ Network: Get ready for our Telegram AMA tomorrow – Best Telegram

ParaState — Telegram AMA — April 04 – Best Telegram

How hackers are getting access to 1000s of Telegram accounts – Best Telegram

How to create a Telegram-RAT (Remote Access Trojan)-2020 – Best Telegram

How to code a Telegram Bot to get stock price updates in pure Python – Best Telegram

How to build a Telegram BOT to suggest you pizza – Best Telegram